Irs 2024 Schedule A Form – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . W ith its homeowner tax breaks and perks, tax season is one of the few times you can get some cash out of your house instead of pouring money into it. With the steady climb of hom .

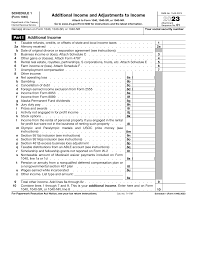

Irs 2024 Schedule A Form

Source : www.investopedia.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 – Money

Source : content.moneyinstructor.comIRS Releases Updated Schedule 1 Tax Form and Instructions for 2023

Source : www.rochesterfirst.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.comInstructions for Schedule M 3 (Form 1120 PC) (Rev. January 2024)

Source : www.irs.govForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.comInstructions for Schedule R (Form 941) (Rev. March 2024)

Source : www.irs.govIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comIrs 2024 Schedule A Form All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: Crypto losses or gains are reported on your personal tax form like any other capital gains tax, including options to offset a tax liability. . Taxpayers who previously used this form will now be required to use Overall, the IRS’s release of the tax refund schedule for 2024 signals the start of another tax season. .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)